Since March 11, the COVID-19 outbreak has been “upgraded to international pandemic status” by the World Health Organization. It has already caused notable disruptions in the global economy and is expected to cause even more damage in the coming months as the disease continues its spread.

The coronavirus became the main factor of uncertainty for the U.S. agricultural sector, in particular as it is closely connected to the global economy and the U.S.-China trade agreement. The 2020 “black swan” causes concerns around the world and directly affects every major industry. The agricultural commodity market cannot remain untouched.

It is now nearly impossible to predict the impact that the virus might have, but some signs are already visible. Those include trade limitations, market fluctuations, production chain disruption, unpredictable demand, and workforce shortages. Let’s take a closer look at some of the most disruptive processes this virus causes and try to understand what farmers should expect in the nearest future.

Restricted trade

Similar to the 2003 SARS epidemic that created a significant slump in the global financial markets, COVID-19 is already causing damage. However, the SARS outbreak reached only 8,000 people whereas the Chinese economy represented roughly 4.3 percent of the world’s GDP at that time.

The coronavirus is already at more than 1 million confirmed cases worldwide (and growing), while the Chinese economy now represents 16 percent of the world’s GDP. This comparison shows the economical importance of China as its value has grown significantly. There are now more industries dependent on its performance than ever.

The peak of the impact is predicted to occur in mid- to late-April, forcing companies to slow down or completely shut their manufacturing. Quarantines are all widespread, and nobody knows for how long they will last since the disease is now rapidly spreading across both the EU and the U.S.

Here the domino effect has begun. Closed borders will make it harder to deliver goods to customers. The consequence would be an overall drop in exports from the U.S. to its main trade partners, Europe and China, for months. This relates directly to farming commodities and agricultural products, though not as much as to electronics and machinery. And since these products are not being exported as they should and stocks are filling up, local prices could begin to drop.

Supply disruptions

The coronavirus situation impacts agriculture supply chains. The ripple effect of the coronavirus in China is being reported in the supply of active ingredients and fertilizers. Lynn Justesen, Technical Services Lead Row Crop at UPL, says the coronavirus quarantines have added additional vulnerabilities for crop protection companies sourcing from China. And anticipating the unknown is something they are trying to prepare for.

Authorities strive to combat the growing uncertainty with reassuring statements and deeming agriculture as a “critical infrastructure.”

“We’re seeing some evidence of unloading taking place and hopefully, we can get past this coronavirus pandemic very quickly and get back to the trade,” stated U.S. Ag Secretary Sonny Perdue. He urged farmers to “do their jobs” “producing safe, reliable, abundant food for all of us in that way.”

Concerns about Beijing’s inability to undergo Phase 1 of the trade deal signed in January, with an obligation to increase the import of agricultural products from the U.S., are also adding fuel to the fire.

“Whether we’re shipping products overseas and not just to China, but other countries, obviously with South Korea being a major ag trading partner, some of the European countries, and as we start to restrict trading, obviously the trickle-down effect does affect prices here in the U.S.,” said Kent Thiesse, a farm management analyst with MinnStar Bank in Lake Crystal, Minnesota.

Prices and Demand

Despite there being a temporary increase in food demand that reflects natural fear of supplies going short, enabling panic buying in food stores, it is believed that demand will decrease after a while. Because of the overall effects on the economy following the supply disruptions, U.S. food producers may experience major reductions in revenue. Moreover, as the U.S. faces significant cuts in imports and exports from China, there’s a major risk of negative demand shock in case the general public overreacts to the COVID-19 outbreak.

This sentiment is supported by people focusing more on buying essential commodities instead of following their casual shopping behavior. Being afraid of the virus exposure, they are increasing their emergency savings rather than being willing to go out to eat, travel or use some services. Subsequently, many workers will receive less pay than usual and will have less to spend cutting demand even further.

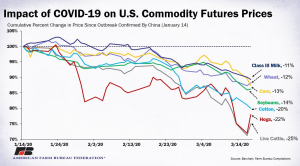

Simultaneously, closed schools, public places, and catering establishments will greatly affect the demand for products like meat and milk, giving producers a hard time selling their more perishable commodities. The graph below shows that the prices for main agricultural products are currently already on average 10 percent lower compared to February:

Similar to other industries responsible for the well-being of the nation, agriculture might need direct federal support in addition to the recent interest rates cut. Consulting major food producers and suppliers may become a much-needed solution to avoid possible disruptions throughout the whole food network thus ensuring stable supply.

From now on, the most viable strategy for farmers might be to cut as many expenses as possible, and this is where precision agriculture tools will be most handy. For instance, modern satellite monitoring systems with low entry prices can help with that. EOS Crop Monitoring estimates that the cost advantage of this technology together with the entire suite of precision agriculture can vary between 5 percent to 20 percent, not to mention better time and workforce management.

Additionally, such tools allow staying home more during quarantine measures as it eases logistics, yield monitoring, and optimize fertilizer applications. Scouting application allows setting tasks for field workers online minimizing face-to-face encounters.

Workforce shortages

Another issue that is potentially damaging to the agriculture industry is farm labor availability. This was already a serious issue in certain parts of the States in 2019. Despite the record number of H-2A work visas issued last year, there were numerous reports from farmers unable to find enough work hands.

Even though it’s too early to predict the farm labor situation for 2020, it’s hard to imagine more immigrant workers being willing to come over, considering the increased spread of coronavirus throughout the U.S. compared with its southern neighbors. New limitations and quarantines might also become a serious issue to workers being able to find employment on the American side of the border.

As is now widely acknowledged, the U.S. farmers are on average part of an older demographic in contrast to other industries. The average age of a farmer here is around 58, and 25 percent of these workers are over 65. Data from other infected countries suggests that COVID-19 is much more severe to senior citizens, meaning that preventive self-isolation recommendations are crucial for farmers. If the disease continues to spread, older farm workers are at risk.

These circumstances suggest that there might be a possibility of below-par spring planting if the virus continues to spread.

Scenarios to expect?

The economic and financial disruptions inflicted by COVID-19 are certainly putting the U.S. economy, including the ag industry, at serious risk. However, the true effect of this impact remains unknown and that is what creates so much uncertainty and panic around the globe.

There are at least three realistic scenarios for the U.S. agriculture industry amid coronavirus panic:

- Optimistic V-shape case. After a rapid decline, the markets revive quickly and show new growth due to accumulated potential and “relieved” demand;

- Neutral U-shape. Slow surging and slow restoration of the market’s normal performance;

- Pessimistic L-shape. Rapid decline and stagnation, possible in case of global panic and pandemic.

The influence of the virus can and must be contained in order to prevent the world economy from another major financial crisis. For that, governments need to act quickly and methodically while communicating their efforts and actions. The consequences will begin to hit full force in a matter of weeks and could last for months if not years.

Alexandr Sakal is chief science officer for EOS Crop Monitoring, a digital agro platform for effective farm management.