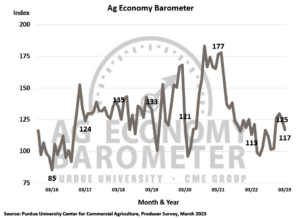

The latest Purdue University-CME Group Ag Economy Barometer suggests that farmer sentiment is continuing to drop this year as the barometer fell 8 points to a reading of 117 in March. Both the Index of Current Conditions and Index of Future Expectations declined 8 points in March leaving the Current Conditions Index at 126 and the Future Expectations Index at 113.

The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. farmer

Though this month’s survey didn’t include any questions directly related to bank closures, it revealed that rising interest rates are an increasing concern for farmers. Some farmers were also quick to respond with concerns over the banking industry’s problems and their potential effect on the economy while weighing in on open-ended survey questions.

Although there wasn’t much change in the Farm Capital Investment Index which only dropped one point from a month prior, respondents seemed to illustrate a change in perspective. Rather than saying that increased prices for machinery and construction were a top reason to avoid large investments, increasing numbers of respondents (34 percent, up from 27 percent in February) indicated that rising interest rates were the primary reason.

Short and Long-Term Farmland Value Indices moved in opposite directions in March. Short-term indexes asking about farmland value expectation in 12 months, fell 6 points this month to a reading of 113. Meanwhile, the long-term index, which addresses outlook over the next five years rose 5 points to 142. The short-term index this month represents the weakest reading since September 2020, and is 32 points lower than last year with one in five producers saying that they expect farmland values to wean in the next 12 months.

Each month, survey questions are included with specific questions — this month’s focused on renewable energy including ethanol and renewable diesel sectors. Half of respondents indicated that they expect the renewable diesel industry to increase over the next five years. Meanwhile, only 25 percent of respondents said they expect the ethanol industry to grow over the same period.

In addition to expecting the renewable diesel industry to increase, 39 percent of respondents indicated that they expected a price increase on soybeans of $0.50 per bushel and 28 percent indicated that soybean prices would increase from $0.50 to $1.00 per bushel. Finally, 21 percent of producers expect soybean prices to rise by $1.00 or more per bushel as a result of increased demand from the renewable diesel industry.

Price declines for wheat, corn, and soybeans during late February and early March likely contributed to a drop in farmer’s sentiments as well as disruptions in the banking sector. Although high input costs are still at the forefront of many producer’s minds, rising interest rates and their impact on operations are becoming an increasing concern.