Recent outbreaks of Highly Pathogenic Avian Influenza (HPAI) within the U.S. layer flock are adding strain to beleaguered egg supply chains, which have not fully recovered from disruptions brought on by the COVID-19 pandemic. While egg production has stabilized in recent months, it is still well below pre-pandemic levels and egg availability could be limited leading into Easter, according to a new research brief from CoBank’s Knowledge Exchange.

“U.S. egg producers have been hard-pressed to align supplies with market demand over the last two years,” said Brian Earnest, lead animal protein economist with CoBank. “The U.S. layer flock typically expands ahead of the surge in demand for Easter and contracts during the summer months. But recent losses due to HPAI have combined with high feed costs and other challenges that are severely limiting flock size management.”

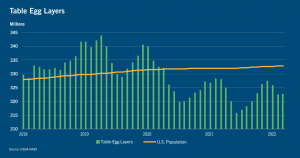

The U.S. table egg layer flock trended ahead of target growth in 2019, however, the annual supply has declined by more than 5% since then. The decline in supply stems from extreme shifts in consumer behavior during 2020. Although grocery demand skyrocketed during the onset of the pandemic, egg producers were not initially set up to shift lost food service volumes into retail channels.

The lack of packaging equipment and supplies needed for grocery sales led to empty store shelves, sky-high retail prices, and ultimately, lower egg consumption. Compounding the pandemic challenges, producers also faced increased input costs of grain, energy, and transportation.

The latest blow to U.S. egg supplies is the worst outbreak of HPAI in years. At least 11 million layers have been lost in recent weeks. With USDA reporting new cases almost daily and depopulation of operations ranging from in the tens of thousands to more than 5.3 million birds, estimating the total expected losses is challenging.

The most recent USDA weekly shell egg demand indicator shows about five days of inventory are currently on hand, which normally suggests a tight, but not alarmingly tight supply. However, it does not appear that supplies will be able to accommodate the reduction in layers as a result of HPAI outbreaks, especially at a regional level.

Current supply pressures coincide with typical in-store grocery features ahead of Easter celebrations. With eggs serving a dual purpose of both decoration and cooking supply, retailers typically rely on eggs as a loss-leader. Market forces result in seasonally higher wholesale values for shell eggs ahead of Easter, but with the tight supply situation now exacerbated by flock reductions, prices are above fundamental ceilings. Consumers are likely to absorb some of the cost increases as they seek to fill their baskets with eggs prior to Easter.