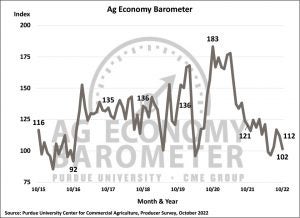

Farmer outlook feel in October according to Purdue University-CME Group Ag Economy Barometer. The sentiment index weakened to a reading of 102, down 10 points compared to a month earlier. The barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from October 10-14, 2022.

Both of the barometer’s sub-indices, the Index of Current Conditions and the Index of Future Expectations, declined this month as well. The Current Conditions Index dipped 8 points to a reading of 101 while the Future Expectations Index dropped 11 points to a reading of 102, similar to sentiments at the end of 2015, beginning of 2016.

»Related: Farm stress and mental health resources for animal ag industry

Interestingly, the fall in sentiment has occurred despite strong net farm income compared to earlier periods. USDA estimates indicate that U.S. inflation adjusted net farm income averaged across 2021 and 2022 is more than 40 percent above the 2015-2016 average.

One of the primary drivers of concerns over farmer sentiment was concerns about farm financial performance, which fell 13 points this month to an 86. High input costs combined with weaker commodity prices continue to drive sentiment down. Shipping conditions, weakening of corn and soybean have also contributed to concerns along with rising interest rates.

Surprisingly, the Farm Capital Investment Index improved slightly after dropping to a record low last month. A large percentage (40 percent) of producers who responded indicated that the increasing costs of farm machinery and new construction was a primary reason for the negative outlook.

Farm values at auctions around the Corn Belt have created new record highs this fall. Both short and long-term value expectations rose this month with the Short-Term Farmland Value Expectation Index rising 10 points to a reading of 133 while the Long-Term Farmland Value Index rising 5 points to 144.

As policy discussions continue around the nation, the Farm Bill is on many producers thoughts. This month’s barometer surveys included a policy question: which two policies or programs would be most important to their farm in the upcoming five years. The top choice was interest rate policy, followed by environmental, conservation and climate policy.