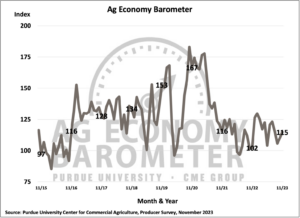

Just in time for holiday cheer, farmer sentiment appears to be on the rise for the second month in a row. At least, that’s according to the latest Purdue University-CME Group Ag Economy Barometer, which climbed five points to an index value of 115, 12 percent higher than a year earlier.

The Current Conditions Index’s rise to a reading of 113 was primarily responsible for this month’s sentiment improvement, as the Index of Future Expectations only improved by 2 points. Both sub-indices exceeded their year-ago levels in November.

“Farmers’ expectations regarding financial performance have improved, with fewer producers expecting worse performance than a year ago,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

The Farm Financial Performance Index was up 3 points compared to a month earlier. The index, which is based upon a question that asks producers to compare their farms’ financial performance this year to last year, was 10 percent higher than at the outset of this fall’s harvest in September and up 25 percent compared to its lowest point of 2023 back in May.

When asked, farmers noted that high input costs were still a top concern, but rising interest rates and lower crop and livestock prices are increasing concerns for farmers.

The Farm Capital Investment Index rebounded to a reading of 42, up 7 points from October. So far, in 2023, the index has ranged from a high of 45 in July to a low of 35 reached in October.

Compared to last summer, fewer farmers chose smaller cash flows, and more indicated high dealer inventories as reasons for large capital investments.

November’s prospective farmland values changed little when compared to a month ago, while the short-term value expectations were maintained.

Producers’ perspective on farmland values changed very little in November compared to October. The Short-Term Farmland Values Expectation Index remained unchanged at a reading of 125, while the long-term index dropped back by 5 points to a reading of 151.

This month’s survey responses were collected the same week that Congress passed an extension of the 2018 Farm Bill to September 30, 2024. Anticipating the possibility that Congress would extend the current Farm Bill into 2024, the November survey asked survey respondents who have a corn and/or soybean enterprise which farm safety net program they would choose for 2024.

Among those respondents who expressed a preference for one program over the other, just over two-thirds of them said they planned to sign up for the Agriculture Risk Coverage farm program, with nearly one-third anticipating that they would enroll in the Price Loss Coverage program, assuming Congress extended the 2018 Farm Bill’s provisions to 2024.

»Related: AgAmerica projects farmland ownership trends in newly released report