My letters through the years have always expressed disgust when I hear traders refer to their weather related positions as:

- “Power weather positions”

- “The boat is loaded”

- “One for the ages”

Those of you that initiate any position because of a weather event will always peril.

This year’s volatility validates my contention.

December corn broke out to the upside $4.17 1/4 on July 11th 2017 due to a hot and dry forecast in the middle of the pollination period.

But guess what, a cool front and a wetter forecast a week-and-a-half later absolutely crushed the short-term weather bulls when $3.79 ¼ flashed on our screens the other day.

This whip-saw, in my opinion, is why so many investors tend to turn away from commodity accumulation. This kind of volatility points to why so many investors are reluctant to switch a small portion of the equities positions into commodities even though they know and understand –

- Commodities can be a perfect hedge against a weak U.S. Dollar.

- Short Bond and T-Note accumulation is in fact an important hedge against the coming spike in interest rates.

- Long Silver and gold positions will protect assets from the coming inflationary cycle.

Right now I’m convinced we are in the midst of a major bull market across the board for the grain market in general. The world population clock is ticking away.

In 1960 global population stood at less than 3 billion.

As you can see below are now at almost 7.5 billion and adding one person every 12 seconds.

Since 2013 we have seen corn futures set back into the lower 25% of the long term trading range due to sufficient supplies.

But don’t be fooled …While supplies have been adequate demand has been through the roof.

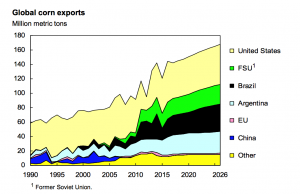

The chart below says it all:

While this might sound presumptuous, my contention is buying corn futures under $4.00 is like buying crude oil futures when crude traded $10.00, or like buying silver futures at $5.00.

I’m sure many would be interested in this kind of investment but the commodity horror stories still scare many.

BE SCARED NO MORE!

My Long Term Practical Strategies (LTPS) offers investors a way to participate and protect assets without the day-to-day, week-to-week volatility most commodity investors endure.

Right now corn futures are in fact in the lower 25% of the long term trading range and my long-term formula is up.

We will hold these positions until corn prices return to the upper 25% of the long term trading range.

Those of you who have a substantial investment portfolio should absolutely have a small percentage of metal accumulation to protect against an inflation spike.

Silver futures accumulation is recommended as silver futures are within my lower 25% parameter.

I think we all realize interest rates are now on the rise. It’s hard for me to believe so many of you are unprotected against credit card exposure, mortgage rate exposure and business loans.

U.S. T-Bonds are in fact in the upper 25% of the long term trading range where long-term short accumulation is recommended.

DON’T STICK YOUR HEAD IN THE SAND.

We all have insurance policies for what we value. Your car, your home, your health, to protect the well being of your family.

Why not protect your assets?

Implementing my Long Term Practical Strategies will insure you will be in the market if chaos returns to our financial markets.

Let me be more specific…

There are four important components regarding my strategies.

1. Positions are established only in the upper or lower 25% of the long term trading range.

2. Positions are established only when my long-term formula turns up or down within that 25% parameter.

3. Positions are held until positions reach the opposite extreme high or low or until my long-term formula changes direction.

4. Correct money management strategies must be implemented. No more than three contracts per $10,000.

Let me be clear. My strategies also incur drawdowns. My contention is if one can establish positions at extremes risk is limited.

My strategies also require one to maintain: Patience, Commitment, Vision and Discipline.

Those of you that have an interest in additional details should call me personally. Would love to hear from you. 312-286-9320.

In the mean time…Keep holding and keep accumulating with my LTPS. Have a great year trading.

The Price Futures Group’s mission is to provide traders and investors with industry-leading trading solutions, informative market analysis, and cutting-edge technologies which enable efficient decision-making. The Group is available answer marketing questions and meet your investment needs. Find the company online at www.pricegroup.com or call the Chicago office at (888) 264-5665.