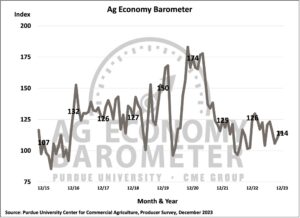

In December, U.S. farmers’ overall sentiment remained largely stable compared to the previous month, reflected in the Purdue University-CME Group Ag Economy Barometer, which recorded a reading of 114, only one point lower than in November. The December survey for the Ag Economy Barometer was conducted between December 4th and 8th, 2023.

Looking ahead to 2024, U.S. farmers’ inflation expectations have notably reduced compared to the start of 2023. Farmer sentiment hit its lowest point in September, rebounding modestly throughout the year, stemming from a more positive assessment of current farm conditions.

Both sub-indices, the Index of Current Conditions and the Index of Future Expectations, also dipped one point from their November readings, standing at 112 and 115, respectively. These indices displayed a slight weakening compared to December 2022, with the Ag Economy Barometer registering a 10 percent decrease from a year ago. Additionally, the current and future indices marked declines of 17 percent and 6 percent from the previous year.

In financial terms, farmers noted ongoing improvements, as seen in the Farm Financial Performance Index, which increased by 2 points from the prior month. This marks an 11-point climb since late summer and a substantial 21-point rise from May’s low point in the year. This upturn coincided with the USDA’s upward revision in late November regarding their 2023 net farm income forecast. While the forecast still indicates a significant drop from the record-high 2022 levels, the inflation-adjusted net farm income estimate for 2023 was $10 billion higher than the August 31st projection.

The Farm Capital Investment Index remained almost unchanged in December at 43, just one point higher than the previous month. Respondents who favored investing at this time highlighted factors like “higher dealer inventories” and “strong cash flows” supporting their viewpoint. Although the proportion citing “strong cash flows” bounced back from the previous month, it remained less popular than in July and August. Conversely, those pointing to “higher dealer inventories” as a primary reason to invest more than doubled compared to July.

High input costs persist as the foremost concern for U.S. farmers, although there has been a noticeable shift in their worries over the year. At the beginning of the year, only 16 percent of surveyed farmers highlighted the risk of “lower crop and livestock prices” as a major concern. By December, this figure rose to just over one-fourth, with 26 percent expressing worry about potential price drops. Another significant concern for the upcoming year was “rising interest rates,” selected by 24 percent of respondents this month.

The survey also delved into farmers’ expectations for consumer inflation and prime interest rates in the upcoming year. Farmers’ inflation expectations have moderated since December 2022, with a notable decrease in those anticipating inflation to exceed 6 percent in the coming year. Contrastingly, a large majority (70 percent) anticipate inflation in 2024 to be less than 4 percent. Regarding interest rates, around one-third of respondents anticipate a decline, while 22 percent expect the prime rate to remain unchanged in the upcoming year.

Both the short and long-term farmland value indices experienced moderate declines in December. Compared to a year ago, the short-term index decreased by 3 points, while the long-term index was nine points higher. The shift in producers’ interest rate expectations could contribute to the relatively improved long-term farmland value index.

»Related: The latest on monopoly pricing power and fertilizer prices