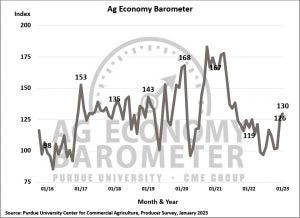

Improved farmer sentiments from December carried into January based on the latest Purdue University-CME Group Ag Economy Barometer Index. The index rose again in January to a reading of 130, four points above its 2022 year-end index value, 34 percent above 2022’s lowest point last June. Despite improved future optimism, farmers indicated that they were anticipating tighter margins in 2023 than they saw in 2022 with larger operating loans and higher operating costs.

The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from Jan. 16-20, 2023.

While producers are feeling better about the future, the Financial Performance Index dropped to 93 this month from down from 109 in December. However, this drop was primarily a reflection of producers being asked to compare 2023 to 2022 rather than comparing 2022 to 2021, as the December question did.

Twenty-two percent of the respondents in this month’s survey said they expect to have a larger farm operating loan than in 2022, which was down somewhat from last January when 27 percent of respondents expected to have a larger operating loan. Among respondents who expect to have a larger operating loan this year, only 5 percent said it was because they are carrying over unpaid operating debt while 80 percent said it was attributable to input cost increases.

The percentage of respondents who attribute their need for a larger loan to unpaid operating debt has fallen sharply since we first posed this question in January 2020. In 2020, just over one-third of producers who anticipated needing a larger operating loan said it was because of unpaid operating debt. That percentage fell to 20 percent in 2021 and 13 percent in 2022 before declining again to just 5 percent in 2023. The sharp decline in the percentage of producers expecting to carry over unpaid operating debt provides support to the idea that the vast majority of producers are entering 2023 in a strong financial position.

The Farm Capital Investment Index climbed two points to 42 in January for the second month in a row. The index, however, is still lower than a year earlier, with just over 70 percent of respondents still indicating now is a bad time to make large investments in their farm operation due to high machinery prices, inflation, and the cost of construction.

Farmers indicated that they believe farmland will hold value rather than increase in value this month. The Short-Term Farmland Value Index declined to fall to 120, 4 points below its year-end reading. Compared to a year earlier, this month’s short-term index was down 22 points, a decline of 15 percent. The Long-Term Farmland Values Index rose slightly to 142 from 140 in December. Over the last year, the long-term index has declined just 2 percent as producers continue to retain a more optimistic long-term than the short-term view of farmland values. Among producers who expect to see farmland values rise over the next 5 years, the top reasons for their optimism continue to be non-farm investor demand and inflation.

It appears that interest in carbon contracts has been relatively consistent. During the first quarter of 2021, approximately 7 percent of survey respondents said they had engaged in discussions with companies about being paid to capture carbon on their farms. When we repeated the question about carbon payments in August 2022 and again in January 2023, approximately 9 percent of respondents said they had discussed a carbon contract with a company. Despite producers’ ongoing interest in carbon contracts, few have signed a contract. Just 1 percent of survey respondents in January reported that they had signed a carbon contract.