Farmers and ranchers have been anxiously watching the development of the American Families Plan. Potential changes in to capital gains tax has been a hot topic since President Joe Biden announced the plan back in April. The proposal would make accumulated gains in asset value subject to capital gains taxation when the asset owner dies.

Under current law, asset value gains can be passed on to heirs without being subject to capital gains taxation because the value of the assets are reset to the fair market value at the time of inheritance. This adjustment in asset valuation, known as a “stepped-up basis,” eliminates capital gains tax liabilities on any gains incurred before the assets were transferred to the heirs.

AFP also included a provision that would exempt from capital gains taxes $1 million in gains for the estates of individuals and $2 million in gains for the estates of married couples, as well as for gains on a personal residence of $250,000 for individuals and $500,000 for married couples.

Gains above these exemption amounts would be subject to tax at death. However, the transfer of a family farm to a family member who continues the operation would not result in a tax upon the death of the principal operator. Under the proposal, any remaining farm and business gains above the exemption amount would receive a “carry-over basis” that effectively defers any capital gains tax until the assets are sold or until the farm is no longer family-owned and operated.

Running the numbers

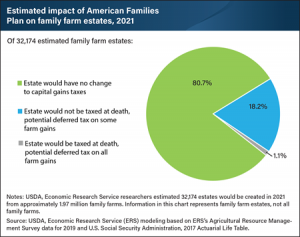

Using 2019 Agricultural Resource Management Survey data, USDA’s Economic Research Service (ERS) researchers estimated that of the 1.97 million family farms in the United States, 32,174 estates would result from principal operator deaths in 2021.

According to the ERS, the proposal estimated that heirs of 80.7 percent of family farm estates would have no change to their capital gains tax liability upon death of the principal operator. Heirs of 18.2 percent of family farm estates would not owe taxes at the time of the principal operator’s death but could be subject to a future potential capital gains tax obligation on inherited farm gains if the heirs stop farming. In addition, heirs of 1.1 percent of estates would owe tax on nonfarm gains upon death of the principal operator and have a future potential capital gains tax obligation resulting from inherited farm gains if the heirs stop farming.

Farmer’s reaction

However, according to a Market Intel article from the American Farm Bureau Federation, farmers are still cautious of this analysis from the ERS and the wording of the proposal.

“Other analysts, including many economists, tax practitioners, and the American Farm Bureau Federation, argue that deferred capital gains taxes can have significant implications for a farm, even if it continues to be operated by the family. This is because it’s easy to say that taxes will be deferred, but it’s hard to write that deferral into law in a way that matches intent, and even harder for the farm’s operators to maintain that deferral. There are many ways that ‘continues to be operated by the family’ could go afoul, including how ‘family’ is defined by the IRS versus how USDA defines it, changes to family status, the rules around recapture, and changes to the rules around material participation, just to name a few. So, while the intent of deferring taxes may be good, those deferred taxes can hang over an operation like a dark cloud.”

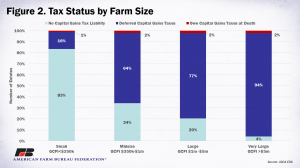

Data from the Market Intel analysis also addresses the fact that results change significantly as farm size increases. When you look at farm size, 64% of mid-size farms, 77% of large farms and 94% of very large farms would have deferred capital gains tax liability as a result of AFP.

In addition, Farm Bureau’s analysis points out the differences when value of production is considered:

- 18.2% of created estates that would not owe capital gains taxes at death but could have deferred tax liability accounted for the vast majority (63.2%) of the value of production of created estates.

- The 80.7% of created estates that would not owe capital gains taxes at death accounted for a little over a third (34.6%) of the value of production of created estates.

- The 1.1% of created estates that would owe capital gains taxes at death only accounted for 2.1% of the value of production of created estates.

Read more of the analysis here.