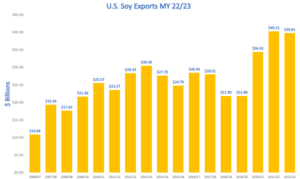

U.S. soy remains the United States’ leading agricultural export in value and volume. Soy complex exports added $39.8 billion to the U.S. economy in marketing year 2022-23 on a volume of 67.6 million metric tons.

The shining star: U.S. soybean meal exports broke records for volume and value at 13.2 MMT and $6.91 billion, respectively.

“U.S. Soy exports in marketing year 22/23 were nothing short of extraordinary. A standout achievement was the record-breaking performance of soybean meal exports, reaching unprecedented volume and value levels,” said Steve Reinhard, United Soybean Board Chair and Ohio farmer. “As we strive to meet the growing international demand and address global food security challenges, sustainability remains at the forefront of our mission, ensuring that our products nourish and uphold environmental responsibility. With a commitment to innovation and sustainability, U.S. Soy continues to lead as a global force in agriculture, providing quality, reliability, and a vision for a better tomorrow.”

Here’s the breakdown

U.S. soybean meal exports

While U.S. processors increased domestic soybean crush capacity, soybean meal has been at the forefront of many conversations.

Increased demand from Colombia and Ecuador in the last five years boosted U.S. soybean meal exports by 15 percent and 36 percent, respectively, above their five-year averages. Meanwhile, increased volume and higher prices saw U.S. soybean meal exports rise in value by 39 percent over the five-year average.

“As we look out ten years, soybean production is forecast to follow the rising productivity curve, continuing to increase on the same amount of land as new innovations, technologies, and improved plant varieties become available to U.S. Soy farmers. This will allow the U.S. Soy industry to continue to meet the need of international (excluding-U.S.) whole soybean export demand and U.S. domestic soybean crush demand,” says Jim Sutter, Chief Executive Officer of the U.S. Soybean Export Council.

The top five markets by volume for U.S. soybean meal exports were:

- Philippines (2.15 MMT)

- Mexico (1.66 MMT)

- Colombia (1.45 MMT)

- Canada (1.2 MMT)

- European Union (0.816 MMT)

- Ecuador, Venezuela, and Guatemala are following closely.

U.S. whole soybeans

Despite persistent global challenges to international business (COVID, climate, conflict, and currency), the volume of U.S. whole soybean exports at 54.2 MMT kept pace with the previous five-year average of 54.4 MMT.

“The consistency of whole soybean demand is impressive given the challenges our international food, feed, and retail customers continue to face,” Sutter indicates. “I believe it is in recognition of the superior value of U.S. Soy, including its optimal nutritional bundle and refining value, lowest carbon footprint, low damage, and reliability — all of which help our customers deliver high-quality food and feed products while improving their bottom lines and advancing sustainability.”

U.S. soybean oil

Following U.S. investment and demand for sustainable aviation fuel and other renewable fuels, U.S. soybean oil exports naturally dipped 82 percent from the five-year average to 171,500 MT.

“This was not a surprise and reflects the increasing investment in renewable fuels in the United States,” says Sutter.

International market development strategy continues to drive customer satisfaction and growth

Josh Gackle, American Soybean Association president and soy farmer from North Dakota, noted the importance of the groundwork done at home to cultivate international demand, saying, “Our industry has created a robust and well-oiled network for collaboration among our national soybean associations to create, develop, and protect international markets for U.S. beans, meal, and oil. For us at the American Soybean Association, that means protecting trade and market development interests from a policy perspective, and then we have the similarly vital roles of the United Soybean Board and U.S. Soybean Export Council in spearheading the actual development of those markets, ensuring the quality and reputation of our products is known, and continuing to pursue pathways whereby our farmers can efficiently get U.S. Soy into those global markets and meet the increasing level of international demand.”

Looking at the total U.S. Soy complex, the top 5 markets were:

- China (31 MMT)

- Mexico (6.6 MMT)

- EU (6.4 MMT)

- Japan (2.7 MMT)

- Philippines (2.3 MMT).

A market that saw significant growth from the previous year was Vietnam, with total U.S. Soy complex imports up 40 percent at 1 MMT. Markets demonstrating moderate growth year over year are EU, Indonesia, South Korea, and China. Morocco, Philippines, and Ecuador were also up slightly.

With export volumes keeping pace with the previous five-year average, higher prices drove an increase in value of the U.S. Soy complex exports which were 35.9 percent percent above the previous 5-year average.

“The U.S. Soy export value chain is the best in the world. Our ability to meet the needs of consumers, companies, and countries around the world due to our expansive and robust infrastructure and logistics, despite challenges, has been proven time and time again,” explains Sutter. “The U.S. export infrastructure has some valuable options which in times of challenge give us reliable flexibility. The U.S.’s ability to utilize a multimodal approach allows for agility when necessary. U.S. Soy delivers whether it be by bulk vessel, rail, or container – U.S. East, West of Gulf Coasts, the Great Lakes, or the Pacific Northwest corridor so we can meet our customers’ needs.”