The Russian invasion of Ukraine substantially elevates the risk of disruptions in the global fertilizer trade. Russia is the world’s largest exporter of fertilizers, accounting for 23 percent of ammonia exports, 14 percent of urea exports, 10 percent of processed phosphate exports, and 21 percent of potash exports, according to data from The Fertilizer Institute. The primary destinations of fertilizers from Russia are Brazil (21 percent), China (10 percent), the U.S. (9 percent), and India (4 percent).

Compared to the U.S., Brazil will be affected more directly as it imports 85 percent of its fertilizers, according to economist from the University of Illinois. Supply in the U.S. should be less of an issue as the U.S. has robust domestic production. However, U.S. farmers are likely to face higher prices because of the global interconnectedness of the global fertilizer industry. On March 11, both nations announced plans to support additional fertilizer production to address rising costs.

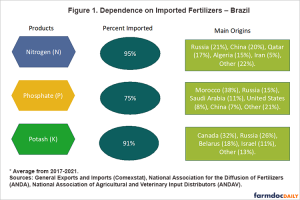

Sources of Brazil Fertilizer

Brazil is responsible for 8 percent of global fertilizer consumption and is the world’s fourth-largest fertilizer importer, behind China (24 percent), India (14.6 percent), and the United States (10.3 percent). About one-fifth of Brazilian imports come from Russia. Adding in fertilizer from Belarus — closely related to Russia — raises the amount imported by Brazil to nearly 30 percent. In terms of direct import from Russia and Belarus, potash is the largest fertilizer import, with Russia and Belarus accounting for 44 percent of the potash imported by Brazil. Brazil is likely to seek more of its potash from Canada, which currently is its largest supplier.

Brazil imports 95 percent of its nitrogen fertilizers, and Russia is the leading supplier, accounting for 21 percent of the amount imported, followed by China, Qatar, and Algeria. In 2020, Brazil produced 224,000 tons of nitrogen fertilizers, which met slightly more than 4 percent of the country´s demand. Brazil currently has only three nitrogen producers.

Brazil imports 75 percent of its phosphate needs, the lowest percentage of the three essential fertilizer components. The main supplier is Morocco, followed by Russia, Saudi Arabia, the United States, and China. These countries account for more than 70 percent of the world’s production of phosphates.

The breakdown of fertilizers applied in Brazil: potassium (38 percent), phosphorous (33 percent), and nitrogen (29 percent). Soybean, corn, and sugarcane production account for more than 73 percent of fertilizer consumption in the country.

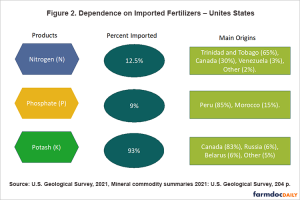

Sources of American Fertilizer

The U.S is the world’s third-largest fertilizer importer and is responsible for 10.3 percent of global consumption. Unlike Brazil, the United States has a robust fertilizer industry. Still, it also could be affected by global supply and regard to prices. The United States, the European Union, and other nations have imposed economic sanctions on Russia, which could hinder Russia’s exports of natural gas, potash, and nitrogen. Belarus, Russia’s ally, is already subject to European and U.S. sanctions restricting its potash exports. Together, Russia and Belarus control 40 percent of the world’s potash supply. In 2021, the U.S. imported about 93 percent of the potash needs. Canada provides 83 percent of the potash used in the U.S.; Russia and Belarus provided 12 percent used in the U.S. in 2021.

The American dependence on nitrogen and phosphate imports is much smaller, 12.5 percent and 9 percent, respectively. Ammonia (nitrogen fixed), for example, was produced by 16 companies at 35 plants in 16 U.S. states in 2020. About 60 percent of total U.S. ammonia production capacity was in Louisiana, Oklahoma, and Texas because of those states’ enormous reserves of natural gas, the primary ingredient for ammonia. Phosphate was mined by five firms at 10 mines, in Florida, North Carolina, Idaho, and Utah.

Before the Ukraine conflict, farmers worldwide were struggling with much higher prices and supply disruptions. The US imports a non-trivial amount of all three components and thus US prices are likely to be connected to world prices of fertilizer. Price increases in the world market are likely to translate into similar price increases in the US market. Since the Russia-Ukraine conflict has started, fertilizer prices reported in the Illinois Production Cost Report have increased.

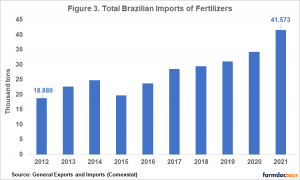

Brazilian Plan to Lower Dependence

On March 11, the Brazilian government instituted a plan to lower its dependence on imports after Russia’s invasion of Ukraine caused a global supply-chain bottleneck. The program, which aims to reduce Brazilian fertilizer imports from the current 85 percent to 45 percent by 2050, includes a new tax policy for the sector and provides support for private firms to expand fertilizer production capacity. In 2021, Brazil imported more than 41 million tons of fertilizers, a record, 21 percent more than last year. The increase in fertilizers consumption is mainly pushed by the growth of acreage in the last years.

The Brazilian plan has 80 goals and 130 specific actions to increase the domestic production of fertilizers. The program also includes: (a) incentives to increase the use of organic fertilizers; (b) financial investments in research; and (c) visits to producers across the country by the Brazilian Agricultural Research Company (Embrapa) to promote increased efficiency in the use of fertilizers and inputs in the field. The government says Embrapa’s effort alone is expected to reduce Brazil’s demand by 20 percent in the 2022/23 crop. Experts say some soils have a residual fertilizer from the past season. If it is analyzed correctly, it is possible to postpone a percentage of the component to the next crop, but with some potential drop in yields. Brazil has two, sometimes three, crops per year.

American Plan to Support Local Production

On March 11, the U.S. Department of Agriculture announced it would support additional fertilizer production for American farmers to address rising costs. This summer, the USDA will provide $250 million through a new grant program to support independent, innovative, and sustainable American fertilizer production. Additionally, to address growing competition concerns in the agricultural supply chain, USDA will launch a public inquiry seeking information regarding seeds and farming inputs, fertilizer, and retail markets.

The USDA will use funds from the Commodity Credit Corporation in September for market disruptions to develop a grant program that provides financing to encourage new, independent production. The application process will be announced in the summer of 2022, with the first awards expected before the end of the year. It is essential to highlight that the proposed US actions are unlikely to impact this year’s availability and price of fertilizer, and its impacts may be several years down the road.

The Russia-Ukraine crisis caused further disruptions and concerns in the global fertilizer industry. Farmers should expect higher fertilizer prices, leading to management decisions about the profitable use of fertilizers. Given the geopolitical consequences of the conflict, these disruptions could play out over many years.