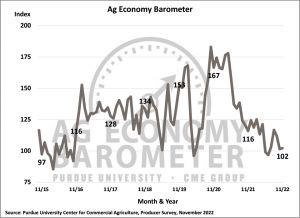

Unlike the two most recent presidential elections, the November mid-term election outcomes did little to swing farmer sentiment. The Purdue University/CME Group Ag Economy Barometer came in at a reading of 102 in November, unchanged from October. Calculated monthly, the Ag Economy Barometer surveys 400 U.S. agricultural producers by telephone. This month’s survey was conducted between November 14 and 18.

A slight three-point movement in the Current Conditions Index reduced the reading to 98 points. The Future Expectations Index, however, increased by two points to 104.

The bottom line: Despite not being much of a change, producers are still looking at their bottom line. Rising interest rates, high input, and energy costs all have agriculture on alert.

Here are some of the highlights of the report

The Farm Financial Performance Index improved modestly to 91, up 5 points from October’s survey. However, this remains 14 percent lower than this time last year. Surprisingly, though one third of producers are concerned about financial performance, two-thirds of the surveyed producers believe their 2022 financial performance will pay out similar to or even exceed 2021.

Despite a relatively positive outlook for financial performance, 42 percent of producers are concerned this month about high input costs. Behind this, 21 percent of respondents top concerns were rising interest rates at 21 percent while 14 percent were concerned primarily with input availability and declining commodity pricing.

Farm prices remained high, but most think it’s a bad time to invest

Auction results for farmland in the Corn Belt have continued to set record highs. Producers, however, are hesitant about farmland value. The Short-Term Farmland Value Expectation Index declined 4 points while the Long-Term Farmland Value Expectation remained unchanged at 144. Both indices are well below the highs established in fall 2021. Of those surveyed, 12 percent said they expected farm values to decline compared to 4 percent last year.

The Farm Capital Investment dropped to a record low of 31 last month, erasing gains from the previous month with 80 percent of respondents indicating that now is a bad time to make large investments. The rising cost of farm machinery and new construction was the primary concern for 47 percent of those respondents. Despite the negative outlook by most producers on making big purchases, 10 percent still feel that now is a good time to make large investments.

Energy prices are a top concern

This year, the surveyed producers were asked about the sharp rises in energy costs. Over a fourth of the respondents indicated that they’ve made changes to their operation based on the increased cost of energy. The top changes made to farming operations were:

- 33% reduced tillage

- 24% reduced nitrogen rates or changed application timing

- 11% increased their use of no-till

- 8% reduced crop drying

A large majority of farmers think high prices for farm machinery and new construction make now a bad time to make large investments in their farming operations. Although most producers expect farmland values to rise over both the next 12 months and the next five years, the percentage of producers who think values will decline in the year ahead has been rising. Looking ahead to 2023, producers continue to cite high input costs as their number one concern. The next Ag Economy Barometer will be released January 3, 2023.