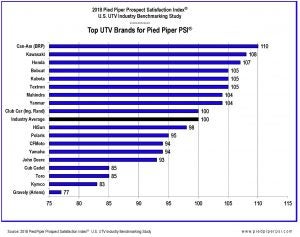

A study has shown Can-Am to be the top UTV brand in the 2018 Prospect Satisfaction Index (PSI), which measures the sales effectiveness of dealers in the utility vehicle market. Pied Piper Management Co.’s PSI looked at the treatment of Utility Task Vehicle shoppers who visited a dealership, with rankings determined by a process that ties “mystery shopping” measurement and scoring to industry sales success.

Kawasaki and Honda were ranked second and third in the study, which was released today. Many of the brands that were measured — such as Kubota, Mahindra, Yanmar, and John Deere — are ubiquitous in agricultural circles for their tractor models while also connecting with rural communities through their utility-vehicle offerings.

For more than 10 years, the automotive and motorcycle industries have used PSI’s “mystery shopping” as a tool to improve the sales effectiveness of their dealer networks, turning more shoppers into buyers. From a customer’s perspective, top scoring brands and dealerships are considered “more helpful,” resulting in greater customer loyalty. Never before has this approach been used to measure the sales effectiveness of the UTV market.

Pied Piper notes a significant difference between typical “customer satisfaction” measurements and what its “prospect satisfaction” entails.

“We measure what happens to all of the customers who shop for a UTV, not just the 1 out of 7 UTV shoppers who buy during their visit to a dealership,” said Fran O’Hagan, President & CEO of Pied Piper. “Customer satisfaction would focus only on the minority of customers who purchase.”

Pied Piper notes that the UTV market overlaps two well-established industries that previously did not compete with each other: powersports (motorcycles, ATVs) and outdoor power equipment (tractors, lawn mowers). Previously the powersports industry focused mostly on leisure, while the outdoor power equipment industry focused mostly on work. Today, for the UTV market, those boundaries are disappearing.

UTV customers today often face an inconsistent experience when visiting dealerships — some dealerships are professionally run, with skilled salespeople who do all they can to be helpful, but there are also locations where UTVs are sold “on the side,” by employees primarily focused on other products. Additionally, specific sales behaviors vary considerably from dealership to dealership, and also from brand to brand. Here are some examples selected from the more than 60 PSI measurements:

- Demonstrate the vehicle. Dealers selling Honda, Kawasaki and Can-Am walked around a vehicle showcasing its features on average more than 90 percent of the time. Dealers selling Gravely, Toro, and Bobcat walked around a vehicle showcasing its features on average less than 70 percent of the time.

- Test drive the vehicle. Dealers selling Yanmar, CFMoto, and Kubota offered an immediate test drive on average more than 40 percent of the time. Dealers selling Polaris, Toro, and Gravely offered an immediate test drive on average less than 20 percent of the time.

- Give reasons to buy — resale value. Dealers selling Club Car, Kubota, and Honda mentioned high resale value as a reason to purchase on average more than 33 percent of the time. Dealers selling Toro and Polaris mentioned high resale value as a reason to purchase on average less than 10 percent of the time.

- Give reasons to buy — service convenience. Dealers selling Club Car, Kubota, Yanmar, and Honda mentioned service convenience solutions (such as mobile “come-to-you” service or service pick-up and delivery) as a reason to purchase on average more than 30 percent of the time. Dealers selling Gravely, HiSun, Toro, and Polaris mentioned service convenience solutions on average less than 20 percent of the time.

- Suggest going through the numbers or writing up a deal. Dealers selling Bobcat, Mahindra, and Honda suggested going through the numbers or writing up a deal on average more than 50 percent of the time. Dealers selling Toro, Gravely, and Yamaha suggested going through the numbers or writing up a deal on average less than 30 percent of the time.

- Mention availability of financing. Dealers selling Can-Am, Kubota, Honda, and Yanmar mentioned the availability of financing options on average more than 65 percent of the time. Dealers selling Gravely, Yamaha, Toro, and Kymco mentioned the availability of financing options on average less than 50 percent of the time.

- Ask for contact information. Dealers selling Bobcat, Kawasaki, and Can-Am asked for the customer’s contact information on average more than 50 percent of the time. Dealers selling Cub Cadet, Kymco, Club Car, and Kubota asked for the customer’s contact information on average less than 35 percent of the time

Research for the study saw some salespeople specifically try to steer the customer to a brand different from the customer’s preferred brand. More than 25 percent of the time, salespeople tried to sell Textron, CFMoto, Yamaha, and Kymco customers another brand instead. In contrast, less than 10 percent of Bobcat, John Deere, or Mahindra customers were steered to competitor brands instead.

“It’s not always easy to be a UTV customer today,” O’Hagan said. “Because the UTV market is still young, strong dealerships with skilled salespeople are an important competitive advantage for UTV manufacturers.”